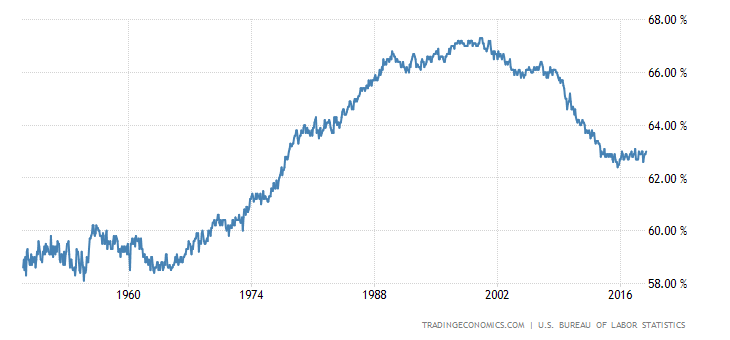

Jobs are in a pretty good spot - it's hard to create a lot more when unemployment is already low, and labor participation is positive. It's also not great when unemployment is high even if a lot of jobs are created -- though of course it helps.

Unemployment Chart

Let's not neglect the zero-order employment levels by focusing only on growth or loss. To me, the worrisome aspect is that slowing growth indicates an inflection point may be here, and that could mean a recession is near. Employment cycles are not clearly correlated to election cycles, so politicians may be victims of the trends as much as the rest of us.

I do wonder if a few hundred $B here and there being repatriated by major corporations will help keep things going up for a little while longer. The Fed rolling back QE might offset that, though. The real question is what sectors will get hit hard and which will be mostly OK in the next downturn. Will cash get clobbered? Bonds? Stocks? Real estate? Crypto currencies? Gold? Commodities?

No comments:

Post a Comment